Retirement Can Mean Different Things for People

Retirement can have many different meanings. For some, it will be a time to travel and spend time with family ...

Read post →

Needs vs Wants: People Move in the Direction of their Wants

Life insurance has historically been sold by the life insurance carriers as a “need” product. They start by offering a ...

Read post →

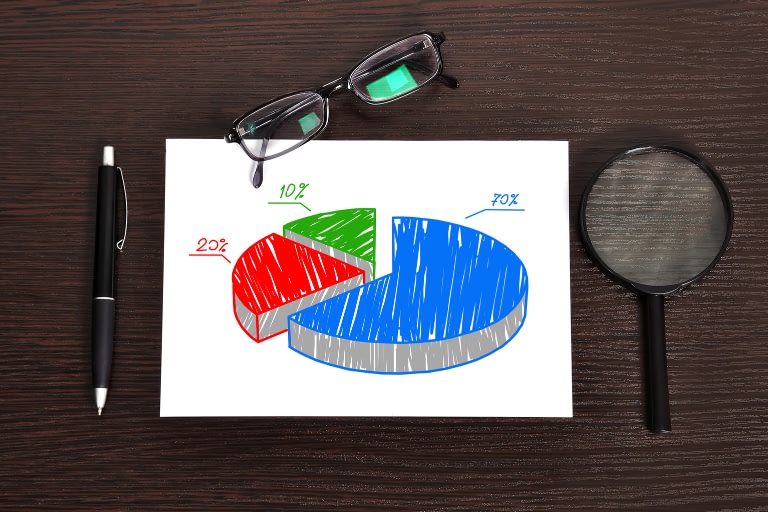

Asset Allocation is a Critical Building Block when Creating a Portfolio

If you live in or have visited a big city, you’ve probably run into street vendors—people who sell everything from ...

Read post →

How much do you know about one of the most important tools you have to help protect you and your family’s financial future?

Life insurance is a key risk management tool that can help you pursue your financial dreams and help protect the ...

Read post →

Tax Time is a Great Time to Review

Every year, about 140 million households file their federal tax returns. For many, the process involves digging through shoe boxes or ...

Read post →

Explaining Term & Permanent Life Insurance to Your Clients and Prospects

According to industry experts, most people don’t have enough life insurance; and, more than half of consumers said their household ...

Read post →

Tips for Setting & Accomplishing Goals

Set goals you actually want to accomplish. Don’t allow outside voices to dictate what your goals should be. While you ...

Read post →

The Other Sure Thing … It’s Never Too Early to Plan

The Other Sure Thing We’ve all heard the saying the only sure things in life is death and taxes. And ...

Read post →