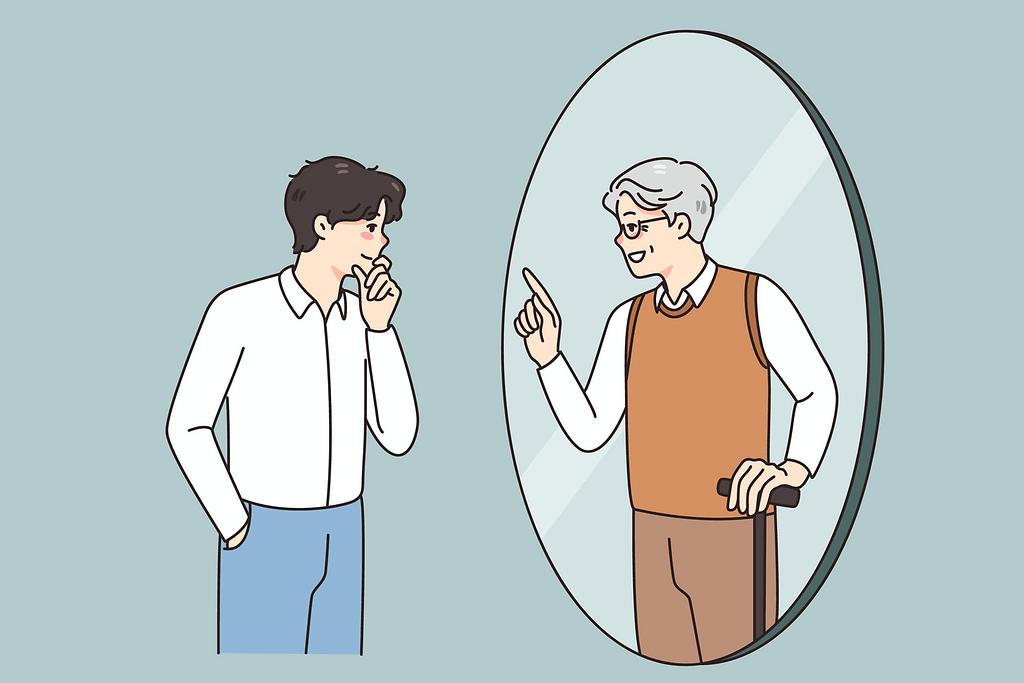

As young adults, we quickly realized that money was one of the most pressing concerns and the most challenging aspects to navigate. Now that we are older and wiser, I am sure we all have wished we could go back in time and warn our younger selves about what the future brings and how to navigate our finances. This leads us to ask ourselves, What is a piece of advice that you regularly give clients now—after years of extra education and real-world experience—that you would tell your younger self?

We asked our colleagues to share the advice they would give to themselves if they could take a step back in time.

Discover their insights below.

Ryan King, owner of Creating Retirement Solutions in Alberta, Canada, would remind his younger self that you do not always have to have it all figured out right now and offer some words of reassurance. King says, “Sure, you should have started earlier. The point is, you are starting now.” It is never too late to save for retirement, so remind your clients to stop wasting time on guilt and regret and just stay focused on catching up.

King also explains that the financial industry is a challenging industry to break in. He says, “In fairness to you, this industry complicates things. You have rules that change, marketing departments with deep pockets, a business that needs your attention, and you’re expected to figure this out by yourself?” Give yourself some grace. You have made it this far and all of your hard work will pay off soon.

Mike Bass, the owner of PrimeQuest Wealth Strategies in Altamonte Springs, Florida, knows the importance of having a structured savings plan. Hence, he says, “Save and invest 20% of every dollar you ever make, then structure your lifestyle around the remaining 80%. If you do, you will never have to worry about retirement and you will never feel guilty about what you spend!” Research studies have shown that clients value a financial advisor who helps them reach their financial goals above anything else. Keep the focus on the client’s goals versus the technical side of your financial planning strategies.

Jeremy Shipp, of Retirement Capital Planners, offers his younger self a wide variety of sound advice on money management, and the importance of insurance. Shipp says, “The most important indicator of having a successful and comfortable retirement is NOT how much money you make while you’re working. It’s how you SPEND your money.” “Don’t try to pay down your mortgage any faster than you have to. It’s more important to have access to cash rather than have a lower mortgage balance.” “Buy more convertible term coverage while you’re young so that you’ll have tax-advantaged parking places for your cash when you start making more money.”

The critical thing to remember, even as a financial advisor, is we all make mistakes and wish we could go back in time for a fresh start, but you can always learn and grow from your mistakes and use them to better yourself.

What would you tell your younger self?